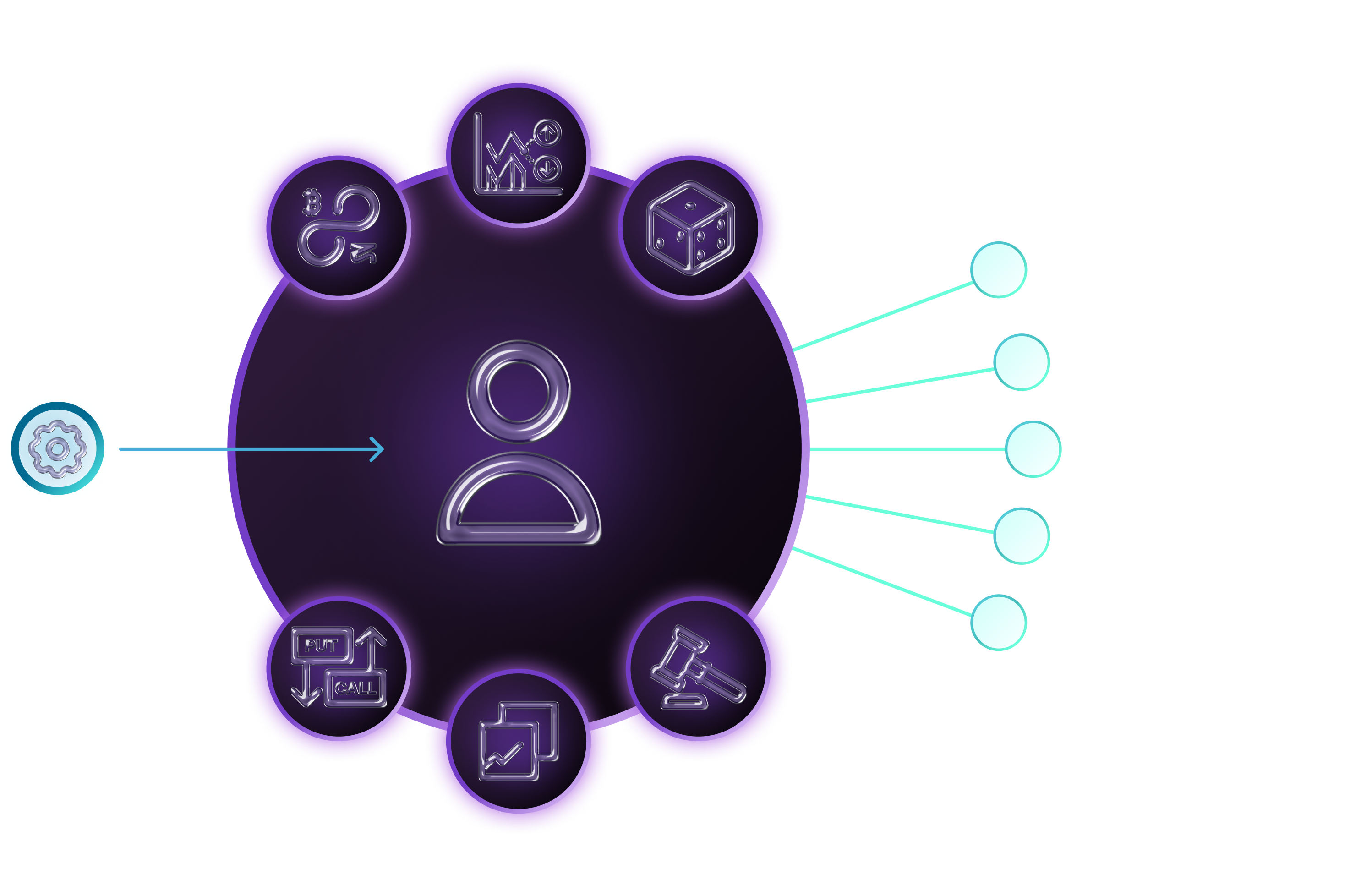

Plug-and-play Market Making Engine for derivatives protocols. Save months of development time and access deep liquidity from day one.

Many derivatives dApps see trading volume plummet post-incentive campaigns and face liquidity challenges for niche assets due to their order-book-based models.

LPs earn up to 30% more on Zaros while using unique yield-bearing assets unavailable elsewhere for derivatives.

All the following derivatives can plug-and-play on Zaros’ Liquidity Solution.

| Integration with AMM based Derivatives | ||||

| Integration with Order Book based Derivatives | ||||

| Compound APR: Accepts yield-bearing assets | ||||

| Cross-chain with margin efficiency for HFT | ||||

| Optimized liquidity by Product or Market Segments |